Do Surveys Work for Validating Problem Hypotheses?

Some Quick Background

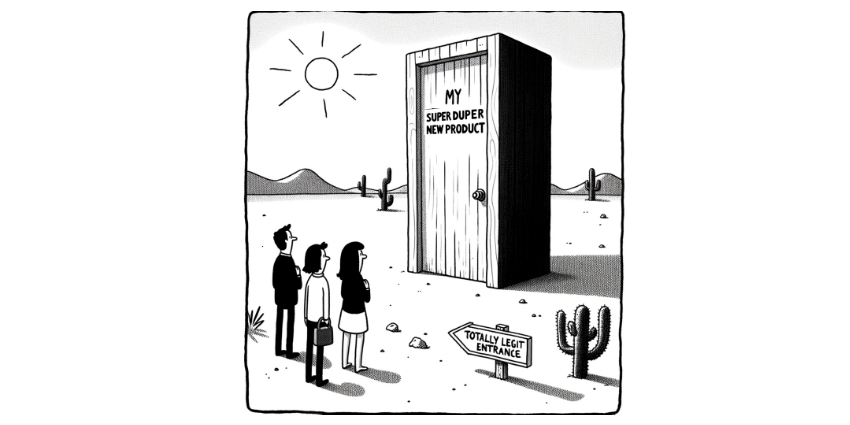

In both the corporate and the startup worlds, the initial stages of developing a new product are pivotal. A key step in this process is identifying customer pain points and forming problem-solution hypotheses. Surveys have traditionally been the favored instrument for many entrepreneurs and corporate innovators, promising a direct and uncomplicated route to understanding market needs and substantiating ideas. This prevalence stems from their ease of deployment and the allure of quick, quantifiable insights. However, the convenience of surveys often masks their inherent limitations. While they offer a bird's-eye view of customer sentiments, this high-altitude perspective can be misleading, overshadowed by the biases of the innovators themselves. The real challenge lies in resisting the temptation of this apparent shortcut and acknowledging that more laborious and time-intensive methods, like in-person interviews, often yield deeper and more nuanced insights.

Innovator Bias

Innovator bias acts like a compass that points more towards your expectations than reality. It's an unconscious influence that shapes the way you design surveys and interpret results. You might frame questions that inadvertently lead respondents to validate your product, akin to asking them leading questions that subtly nudge them towards affirming your assumptions.

The Illusion of Depth

Surveys, with their neatly lined questions and tick-boxes, often skim the surface of the ocean while claiming to chart its depths. They remind us of a high school romance – brief and superficial. The real depth, the kind that uncovers the hidden crevices of customer needs, lies beneath these superficial waves. For instance, imagine asking people if they like your app's new feature. They say yes, but is it a genuine yes or just a polite nod?

The Echo Chamber Effect

This bias turns surveys into echo chambers, reflecting back your own hypotheses and beliefs. It’s akin to seeking validation rather than genuine insight, like a chef who only inquires if diners love the dish, never probing for potential improvements or dislikes. The result? A skewed understanding of your market, based on what you want to hear, not what you need to know.

Other Challenges

The challenge extends beyond crafting unbiased questions to being receptive to all feedback, not just that which supports your views. It's the tendency to focus on data that aligns with your hypothesis, overlooking contradictory information. It's comparable to a detective fixated on a single suspect while disregarding other crucial leads.

Some Alternatives to Surveys

In-person Interviews

Shift your focus from surveys to interviews. Here, the aim is to delve deeper with open-ended questions that encourage genuine feedback, much like an improvisational conversation rather than a scripted questionnaire. While it's true that this method is often more time-consuming, less scalable, and requires a greater investment of resources compared to surveys, the depth and quality of insights gained can be significantly more valuable because they:

a. They tend to delve into the 'why' behind customer behaviors and preferences, providing a richer, more detailed understanding of customer pain points and needs.

b. Interviews can be more adaptable. If an interesting point or unexpected insight arises, you can immediately dive deeper. This flexibility helps uncover insights that a fixed survey format might miss.

c. By engaging in a real conversation, you’re more likely to get honest, unfiltered feedback.

d. In-person conversations are better at challenging and verifying your own assumptions. You might enter an interview with a certain belief about your customer, only to find that reality is quite different. This is harder to achieve with the rigid structure of a survey.

Prototype Testing

Turn your attention from hypothetical scenarios to real-world interactions with prototype testing. This hands-on approach involves presenting customers with a functional, albeit basic, version of your product to interact with and provide feedback on. While prototype testing may seem resource-intensive and less straightforward compared to surveys, its advantages in yielding actionable insights are substantial:

a. Engaging customers with a tangible representation of your product idea allows you to test and refine your assumptions in real-time. For example, a feature you assumed would be popular might be ignored, or a minor feature might unexpectedly capture users’ interest.

b. Prototype testing facilitates an immediate feedback loop. As customers use the product, they can provide instant reactions and suggestions, allowing for a dynamic and responsive development process.

c. Involving customers in the development process through prototype testing can build a sense of investment and loyalty. It creates a narrative of co-creation, where customers feel their input directly shapes the product.

d. Observing how customers interact with a prototype in real-time provides genuine behavioral insights. You can see not just what they say they would do, but what they actually do, which is often different.

Conclusion

In the intricate landscape of customer research, discerning the most effective approach requires both precision and a strategic mindset. In-person interviews and prototype testing are akin to high-resolution lenses, offering a detailed and granular view of customer behaviors and preferences. These methods are essential for those seeking to delve beyond superficial understanding, providing rich, qualitative insights that are often lost in more broad-brush approaches.

Surveys, while sometimes critiqued for their potential to skim the surface and echo innovator biases, are not without merit. They serve as an efficient tool for initial explorations, offering a broad overview that can be invaluable for identifying trends and patterns across a larger audience. This approach is akin to conducting a reconnaissance mission - gathering preliminary intelligence that can inform more targeted, in-depth investigations.

The art lies in knowing when to deploy each of these tools. Surveys are most beneficial when quick, general feedback is needed or when reaching a wide demographic is crucial. However, when the objective shifts to a deeper understanding of nuanced customer experiences, in-person interviews and prototype testing become indispensable. They allow for a more dynamic and interactive exploration of customer needs, leading to insights that are both profound and immediately applicable.

In summary, the key to effective customer research is a balanced, informed approach. By judiciously combining the broad reach of surveys with the depth and authenticity of interviews and prototype testing, one can attain a comprehensive and nuanced understanding of customer needs, driving informed and impactful product development.